The park at ashford

144 units

3550 S Fielder Rd, Arlington, Tx 76015

Current Investment Opportunity

Discover 412 E 9th ST Phase 1

Dive Deeper into the Exclusive Deal for Accredited Investors

The Build-to-Rent (BTR) market continues to redefine the housing landscape. In 2024, the sector recorded 27% year-over-year growth, with more than $14.8 billion in institutional capital deployed nationwide. As homeownership becomes increasingly out of reach for many Americans—driven by higher mortgage rates, rising insurance costs, and limited housing supply—renters are seeking alternatives that deliver the space, privacy, and lifestyle of single-family living without the financial burden of ownership.

BTR fills this gap, combining the comfort of single-family homes with the convenience of professional management, creating a modern rental experience that resonates with today’s evolving renter demographic. For investors, the asset class offers durable income, operational efficiency, and defensive performance across market cycles.

Our latest project, 412 East 9th Street – Phase I, is a prime example of our fund’s strategy to invest in high-quality, infill BTR communities within growing urban submarkets. Located in Bishop Arts, one of Dallas’s most vibrant and rapidly developing neighborhoods, this 14-unit, new-construction, Class A townhome community represents a well-positioned opportunity to capture both near-term value creation and long-term appreciation potential.

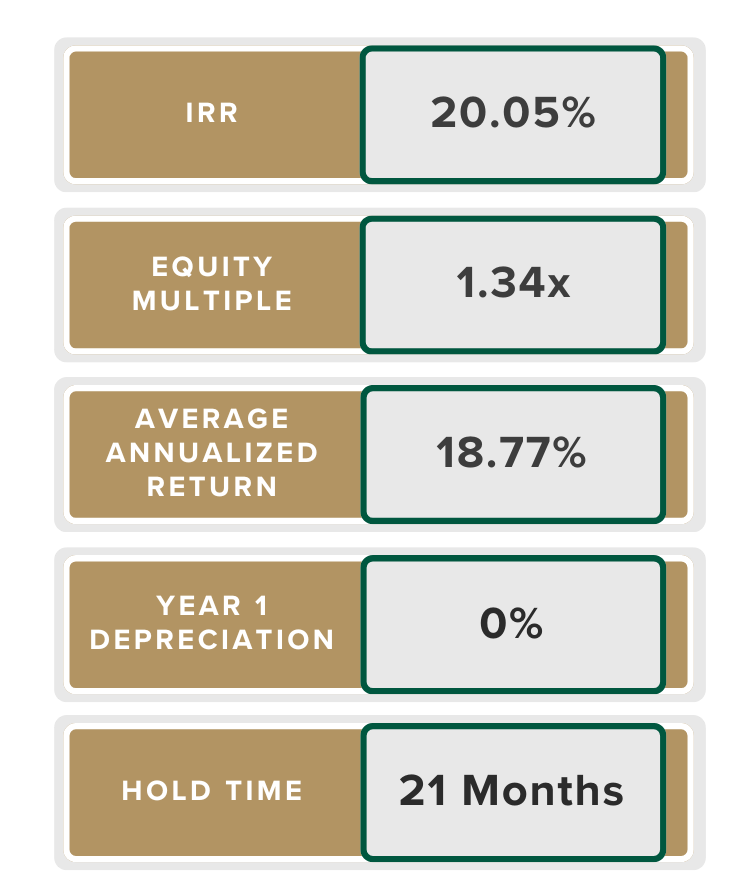

iNVESTOR RETURN SUMMARY*

*Actual returns may vary and there is no guarantee you will make a return on your investment

Invest WITH US

Why We’re Excited About This Opportunity

- Prime Location – Nestled in the heart of Bishop Arts, a vibrant, walkable community filled with over 60 local restaurants, shops, and galleries—positioning the project for strong rental demand and long-term appreciation.

- Proven Development Partner – Partnering with a seasoned local developer with a track record of delivering high-quality projects throughout Dallas.

- Sustained BTR Demand – With rising mortgage rates and lifestyle flexibility driving renters toward high-end single-family rentals, BTR communities continue to outperform conventional multifamily assets.

- Short Hold Period – A 21-month investment horizon offers investors an attractive near-term return profile and early liquidity event.

vERTICALLY INTEGRATED SPONSOR

AG Living’s proven track record of fixing and repositioning dated assets is built on proactive management of every property, protecting the value of each asset, and ensuring a community culture aligned with our core values.

DIVERSIFIED CASH FLOW REAL ESTATE

Disclaimer: This Business Plan contains privileged and confidential information and unauthorized use of this information in any manner is strictly prohibited. If you are not the intended recipient, please notify the sender immediately. This Business Plan is for informational purposes only. The information contained herein is from sources believed to be reliable, however, no representation by Ashland Greene (“Sponsor(s)”), either expressed or implied, is made as to the accuracy of any information on properties described herein. An investment in this offering will be a speculative investment and subject to significant risks, therefore investors are encouraged to consult with their personal legal and tax advisors. Neither the Sponsor(s), nor their representatives, officers, employees, affiliates, sub-contractor, or vendors are providing tax, legal, or investment advice. The Securities and Exchange Commission (“SEC”) has not passed upon the merits of or given its approval to the terms of the offering, or the accuracy or completeness of any offering materials. However, prior to making any decision to contribute capital, all investors must review and execute the Private Placement Memorandum and related offering documents. Potential investors and other readers are also cautioned that forward-looking statements contained herein are predictions only based on current information, assumptions, and expectations that are inherently subject to risks and uncertainties that could cause future events or results to differ materially from those set forth or implied by such forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, such as “may,” “will,” “seek,” “should,” “expect,” “anticipate,” “project, “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Financial Disclaimer: This Business Plan further contains future financial projections and forecasts. These estimated projections are based on numerous assumptions and hypothetical scenarios and Sponsor(s) explicitly makes no representation or warranty of any kind with respect to any financial projection or forecast or any of the assumptions underlying them. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data presented. All return examples provided are based on assumptions and expectations in light of currently available information, industry trends, and comparisons to competitors’ financials. The Sponsor(s) further makes no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown in the proformas or other financial projections. Please note that securities will only be offered and sold to “accredited investors” as that term is defined in Rule 506(c) of Regulation D promulgated by the SEC.